News, options scans, audio squawk and a great community, make Benzinga Pro an excellent choice. You can use extensive charting functionalities and code your own indicators and strategies. You can view up to 500 symbols at the same time in the Signature Package. The Gold Package for $29.99/month should have all the essential tools that most investors are looking for. For example, the real-time U.S. stock data costs an additional $14.99 per month. Also, Trade Ideas implemented an artificial intelligence based trade alert stream, supports automated trading, fast and reliable backtesting, and scans for hundreds of trading strategies.

The PRO+ service is $19 monthly and has extensive benefits, including multiple devices, screens, charts, and post-market data. Trade Ideas uses AI to backtest millions of conditions daily to generate higher probability day trading signals. Trade Ideas is the best Automated trading software; using the Brokerage Plus program, you can automatically trade the Holly AI algorithm signals with Interactive Brokers. No reason to take sides when 2 traders debate regarding Vimeo stocks, for example—you can just turn to your analysis software and make your decision easily. However, the most important factor is to take your time to make the right decision. As we have outlined, there are several aspects to take into consideration when researching the best stock analysis software for you.

Key Aspects to Consider in your Stock Analysis Software

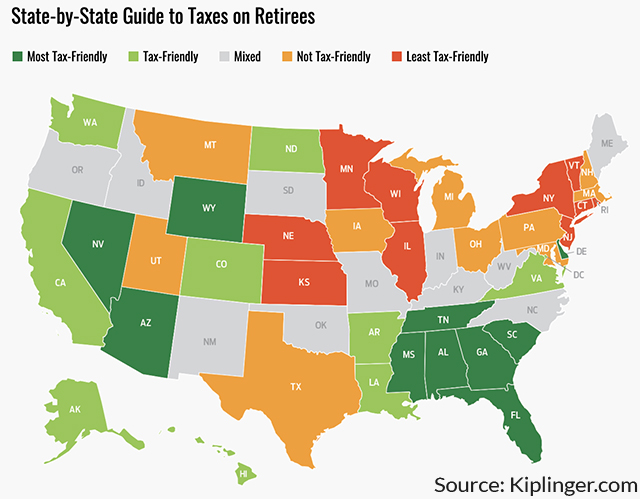

TradingView covers Stocks, ETFs, Funds, Futures, Forex, Bonds, and cryptocurrencies globally, making it a good choice for international investors. News feeds offer Kiplinger, Futures Magazine, DailyFX, StockTwits, and FXStreet. The news section is only beaten by MetaStock with its Reuters Feeds.

- As one of the best stock research tools, AltIndex enables investors to secure a first-mover advantage.

- Zacks Investment Research has a comprehensive stock screener solution with high functionality supported by a massive number of metrics.

- Released way back in 1985, this powerful tool has stood the test of time—and it still offers so much value that it easily earns the #2 position in our list.

- The platform is built on HTML 5 and needs Zero installation and Zero data feed configuration.

By analyzing a company’s financial statements, you can identify if a company has… If you’re not sure exactly what you’re looking for, you can learn how to research stocks before you dive in. Access financial ratios and graphs to monitor key company trends. Select from hundreds of data points to chart historical data back to 2007. Another standout feature is the extensive earnings per share (EPS) metrics, allowing you to delve more deeply into a company’s relative performance compared to its EPS history. Remember, though, as useful as this platform is, your management fees could rise depending on the size of your portfolio.

Finviz – Best Free Stock Analysis Tool for US Markets

It also gives users access to screeners for mutual funds, ETFs and futures. You shouldn’t pick stocks for your portfolio based on a hot tip you got from a friend or from a TikTok video. Selecting stocks takes some consideration; it’s best not to do it on a whim. Free stock screeners can help you make informed decisions when it comes to adding investments to your portfolio.

A standard plan is available for $118 a month without full access to AI technology, and a further discount is available if you pay annually. There is also a third, baseline option called TI Strength Alerts for $17 a month that gives you five new trade ideas every Sunday. The stock screener employs leading-edge back testing and automated trading features with multiple filters. With more experience, traders can choose to customize their screens with their own criteria.

Futures Mixed As Yields Near Key Level; UAW Strike Underway – Investor’s Business Daily

Futures Mixed As Yields Near Key Level; UAW Strike Underway.

Posted: Fri, 15 Sep 2023 10:57:00 GMT [source]

You have to try it and see it in action to understand the power of the implementation. You can use a limited set of features for free; subscriptions with access to additional features and data are $14.95–$59.95 per month. There’s a paper trading system built-in, or you can link TradingView to a brokerage account with several brokers, including TradeStation.

You can have TradingView for free; it has also won our Premium Subscription Stock Software Review for the last five years. The prices are reasonable and unlock a lot of extra functionality. If you like TradingView, you can upgrade to PRO for only $10 per month; the benefits include priority customer support, alerts, backtesting, and screening.

If you aspire to be an active, profitable day trader, this package is well worth it, as all the hard work is done for you every day. I am thrilled to partner with Trade Ideas because they bring a unique and extremely powerful service to retail stock traders. TradingView has over 160 stock chart indicators and unique charts such as LineBreak Charts, Kagi Charts, Heikin Ashi, Point & Figure Charts, and Renko Charts. With TradingView in the USA, you get broker integration with TradeStation for stocks and Forex.com for foreign exchange currency trading. In Europe, you have integration FXCM and Saxo Group for currency and CFD trading. You can place trades directly from charts, which will take care of profit & loss reporting and analysis.

Compare the Best Stock Screeners

For example, you can select to be alerted via email or a desktop pop-up and sound if any hot news or market-moving news is announced. Any category can be flagged for alerts, so you do not need to watch the newsfeed continually; you can be trading and hear the alarm as a call to action. The only news excluded in the basic package is the Securities & Exchange Commission (SEC) announcements and Public Relations (PR) newsfeeds. Another example of how Benzinga is continually innovating is Signals. Signals is a feed with block trade or price spike news that directly impacts a stock’s supply and demand balance at a foundational level.

Industrial AI Software Market [2023-2029]:Analysis, Technical Study and Business Opportunities – Benzinga

Industrial AI Software Market [2023-2029]:Analysis, Technical Study and Business Opportunities.

Posted: Fri, 15 Sep 2023 07:23:55 GMT [source]

Stock Alarm, for example, offers real-time alerts on thousands of stocks. For instance, the investor might want to view stocks based on a selection of technical indicators and fundamental ratios. RadarScreen updates in real-time, ensuring that trading opportunities are never missed. This enables traders to test their strategies and assess how they would have performed across 30+ years of data. While this comes with limited functionality, it enables traders to buy and sell stocks on the go. Thinkorswim also supports other asset classes, including options, futures, forex, and ETFs.

Benefits of Stock Trading Software

These tools cannot be accessed by individual investors outside brokerage platforms, but you will find their technology built into quite a few active trader sites. 2009 is committed to honest, unbiased investing education to help you become an independent investor. We develop high-quality free & premium stock market training courses & have published multiple books. We also thoroughly test and recommend the best investment research software. Most brokers allow you to practice stock trading for free using paper trading, but they are usually restricted to one country. If you want to practice trading stocks, Forex or Cryptocurrency for free across the global markets, then we recommend TradingView’s free paper trading system.

Version 20 has Windows, Mac, mobile, and web platforms available, plus you can connect directly to Interactive Brokers to place trades through TC2000 Brokerage. TC2000 combines charting, stock and option screening, and trading features, and you can use the practice version for free. Thinkorswim allows traders to create their own analysis tools as well as use a built-in programming language called thinkScript. The desktop version of thinkorswim is the most powerful, but you can also use a web version or the mobile app. All include streaming real-time data powering more than 400 technical studies. Active Trader Pro is Fidelity’s downloadable trading interface, offering a deeper feature set than is available through the website.

Who are TradingView?

While those with a score of 30 or under are considered a strong sell. AltIndex is also the best stock trading software for time-starved investors. This is because the platform sends real-time alerts when it generates a new stock recommendation Those with more time on their hands can view stock ratings manually. That, coupled with its very reasonable pricing, makes Stock Rover our choice as the best stock screener for buy-and-hold investors. FINVIZ’s stock screener has been a popular choice for investors since it was created in 2007.

With its lightning-fast platform and AI-driven functionalities for screening hundreds of criteria, Trading Ideas makes our list as the best stock screener for day trading. Individual investors are often advised to leave stock picking to the professionals. They have the resources and a deep bench of analysts nostro vostro loro to help them search the vast universe of stocks and sort through mountains of data. The New York Stock Exchange alone has 10 markets and more than 2,400 company stocks, and that’s not counting an additional 3,300 on the NASDAQ. Therefore, Stock Rover can become the hub for all investment activities.

I have personally reviewed many of them, and they are very thoughtfully built. Expertly implemented, fast, and extremely configurable, Portfolio123 has the best backtesting service for people https://1investing.in/ serious about testing fundamental strategies. Tickeron is designed to find high-probability trading opportunities, not for long-term investors wishing to build a sustainable portfolio.

- However, you will need the latest generation of processors if you run trading software on your PC and process a lot of data locally with software like MetaStock or Optuma.

- Most traders spend years learning the markets and learning how to build trading scripts—and lose a bunch of money in the process—before finding one that works consistently.

- Alternatively, some investors will want to test out new strategies in a risk-free environment.

- You don’t even have to pay for another subscription service for thinkorswim model.

- Fidelity’s web-based charting has integrated technical patterns and events provided by Trading Central.

FINVIZ is a great option for investors who want to quickly uncover a variety of stock ideas based on technical and fundamental data. Through detailed research of the most popular free stock charting tools on the web, Liberated Stock Trader has compiled the definitive review. We tested 30+ free charting services against 29 factors; the best made our top 10.